nc estimated tax payment calculator

Underpayment of Estimated Income Tax. What is individual estimated income tax.

Tax Calculator Estimate Your Taxes And Refund For Free

If only the monthly payment for any auto loan is given use the Monthly Payments tab reverse auto loan to calculate the actual vehicle purchase price and other auto loan information.

. That way you can at least get valuable credit card rewards and points when you pay your bill. Our income tax calculator calculates your federal state and local taxes based on several key inputs. If interest on the underpayment is applicable add the amount of interest to the tax due and include the full payment with the return.

The calculator should not be used to determine your actual tax bill. I live in VA and work in NC In performing my tax review the software flagged my estimated tax payments bc I checked 1a and 3a on the estimated tax worksheet. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes.

You have nonresident alien status. The IRS has authorized three payment processors to collect tax payments by credit card. There is a variation on lottery tax on winnings according to country policy for lottery winners.

Property Tax 2192. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. Your tax situation is complex.

PO Box 25000 Raleigh NC 27640-0640. Pay individual estimated income tax. To pay individual estimated income tax.

In addition if you dont elect voluntary withholding you should make estimated tax payments on other. Individual estimated income tax. Percent of income to taxes 34.

Estimate your tax withholding with the new Form W-4P. Total Estimated Tax Burden 25676. The Auto Loan Calculator is mainly intended for car purchases within the US.

The underpayment penalty is owed when a taxpayer underpays the estimated taxes or makes uneven payments during the tax year that result in a net underpayment. 7 Mail the completed estimated income tax form NC-40 with your. Use Form 1040-ES to figure and pay your estimated tax for 2022.

Want to schedule all four payments. 2000 Form D-422 Web Underpayment of Estimated Tax by Individuals - Use this form to see if you owe a penalty for underpaying your estimated tax. To make the easy calculation for lump-sum lottery taxes state-wise in the USA and country-wise for the rest of the world.

7 Mail the completed estimated income tax form NC-40 with your payment to. It is warning me of possible penalty for next year if my withholding is. See Publication 505 Tax Withholding and Estimated Tax.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Waiver of Penalty or Interest. Overview of North Carolina Taxes.

Nc estimated tax payment calculator Friday March 4 2022 Edit. This can make filing state taxes in the state relatively simple as even if your. 156355 plus 37 of the amount over 523600.

May still use the calculator but please adjust accordingly. People outside the US. As you pay your tax bill another thing to consider is using a tax-filing service that lets you pay your taxes by credit card.

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Click here for help if the form does not appear after you click create form. Please do not send cash.

Income tax you expect to owe for the year. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments. North Carolina Department of Revenue.

Use Notice 1392 Supplement Form W-4 Instructions for Nonresident Aliens. Your household income location filing status and number of personal exemptions. This includes alternative minimum tax long-term capital gains or qualified dividends.

File Pay Taxes Forms Taxes Forms. Interest on the underpayment of estimated income tax is computed on Form D-422 Underpayment of Estimated Income Tax by Individuals. Nc estimated tax payment calculator Sunday March 13 2022 Edit.

NC-40 Individual Estimated Income Tax. IRS Form 2210 is used to calculate the amount of taxes owed subtracting the amount already paid in estimated taxes throughout the year. Make one payment or.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc. PayUSAtax Pay1040 and ACI Payments Inc. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and.

Your county vehicle property tax due may be higher or lower depending on other factors. Youll need to make the payments four times per year according to these due dates. Which bracket you land in.

6 Enter your social security number on your check or money order. You can also pay your estimated tax online. 46385 plus 35 of the amount over 209400.

Created with Highcharts 607. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. North Carolina Salary Tax Calculator for the Tax Year 202122 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122.

April 15th payment 1 June 15th payment 2. Please enter the following information to view an estimated property tax. Use eFile to schedule payments for the entire year.

Individual Income Tax Sales and Use Tax Withholding Tax. Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download Income Tax Calculator Estimate Your Refund In Seconds For Free City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return. Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes.

Schedule payments up to 60 days in advance. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

NC Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0630. How to calculate estimated taxes and make a payment.

North Carolina Income Tax Calculator Smartasset

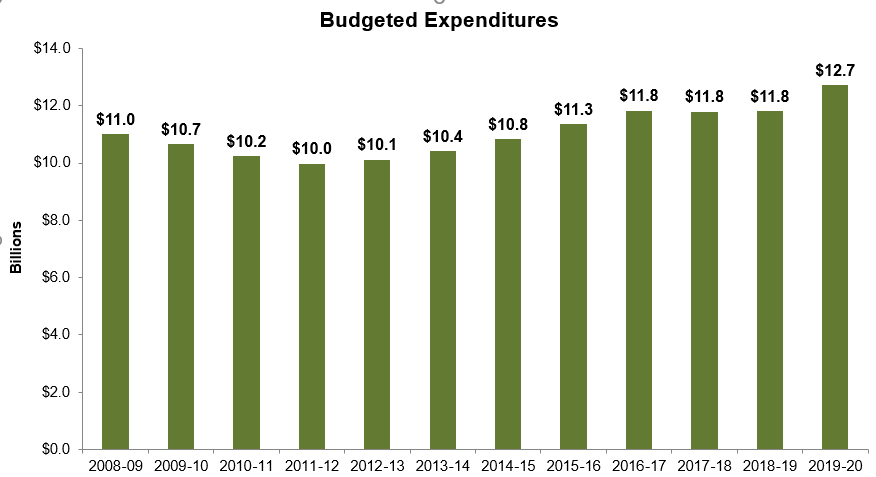

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Paycheck Tax Withholding Calculator For W 4 Form In 2021

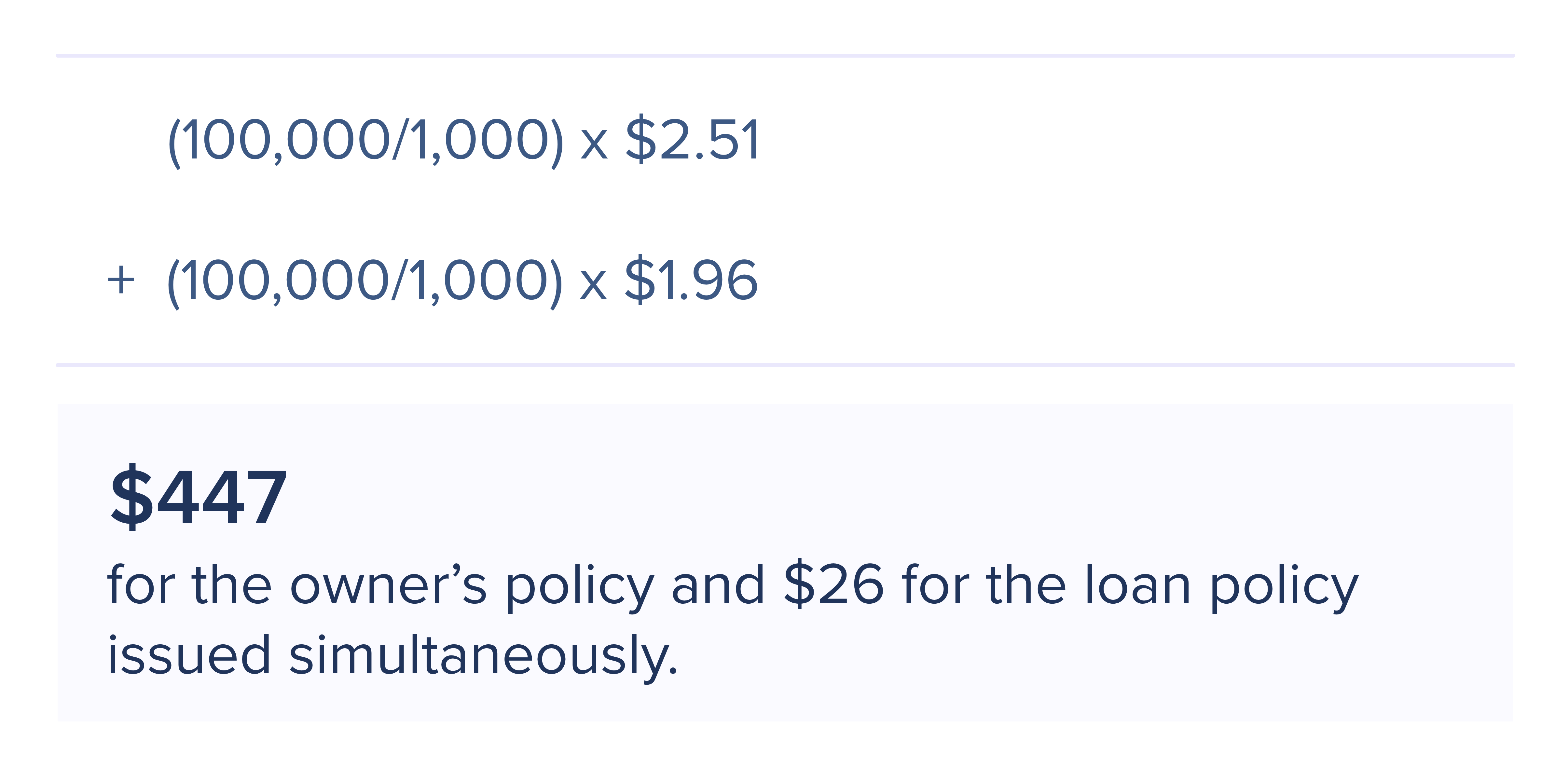

North Carolina Title Insurance Calculator With 2022 Rates Elko

Quarterly Tax Calculator Calculate Estimated Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Tax Calculator Estimate Your Taxes And Refund For Free

Solar Calculator Solar Panels Calculator Solar Energy Payback Calculator Solar Panel Calculator Solar Energy System Solar Calculator

Health Insurance Marketplace Calculator Kff

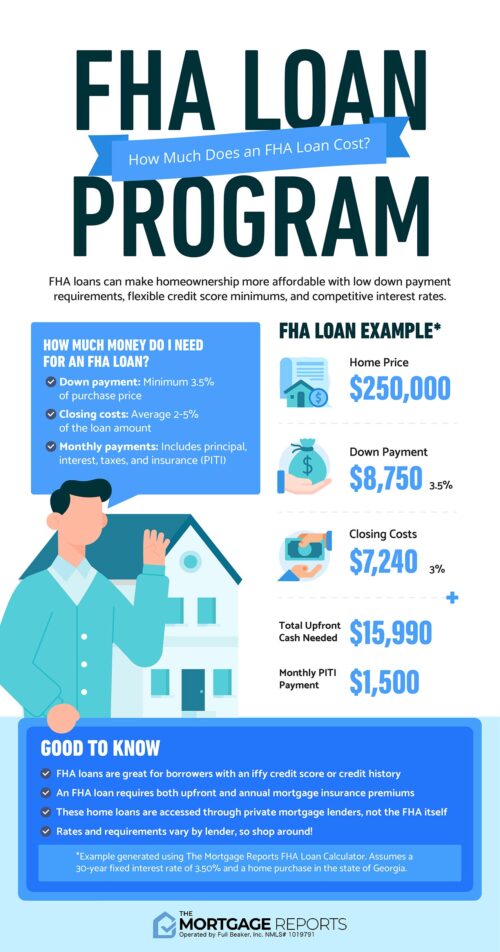

Fha Loan Calculator Check Your Fha Mortgage Payment

North Carolina Title Insurance Calculator With 2022 Rates Elko

How To Calculate Closing Costs On A Home Real Estate

Salary Paycheck Calculator Calculate Net Income Adp

Quarterly Tax Calculator Calculate Estimated Taxes

North Carolina Income 2021 2022 Nc Forms Refund Status

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Tax Withholding For Pensions And Social Security Sensible Money